IT SOFTWARE 2018-19.

INCOME TAX 2019-20 INFORMATION

Income Tax Software 2017 -18

IncomeTax Calculation Guidelines in Telugu

IT REQUIRED FORM- 2017-18

INCOME TAX SOFTWARE 2016-17

* INCOME TAX SOFTWARE 2016-17

INCOME TAX - Additional Rs.50000 Tax Benfit on NPS(CPS) Employees

Guidelines and Certain clarifications on recovery of incometax for financial year 2016-17

* Government of India Official Income Tax Calculator 2016-17 Download

* Income Tax Department Tax Preparation Guidelines Download

INCOME TAX -2016-17 CALCULATION IN TELUGU

Know your PAN Know your TAN TAX CALCULATOR

Income Tax Rates are applicable for Financial Year 2016-17,Assessment Year 2017-18

|

Income Tax Old Slabs

|

Income Tax New Slabs

|

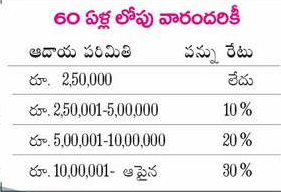

General

|

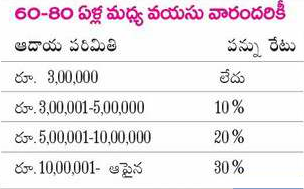

Senior Citizen

|

Super Senior Citizen

|

| Upto Rs. 2.5 lakh Rs. 2.5 lakh-3 lakh Rs. 3 lakh- 5 lakh Rs. 5 lakh- 10 lakh Above Rs. 10 lakh REBATE RS.5000 |

Upto Rs. 2.5 lakh Rs. 2.5 lakh-3 lakh Rs. 3 lakh- 5 lakh Rs. 5 lakh- 10 lakh Above Rs. 10 lakh |

Nil 10% 10% 20% 30% |

Nil Nil 10% 20% 30% |

Nil Nil Nil 20% 30% |

INCOMTAX SOFTWARE 2015-16 INCOMETAX E-FILING- SELECT

Computation of income from house property- Download

Taxability of various components of salary - Download

Information for 80 CCD- Download

Deductions Under Chapter VIA- Download

INCOME TAX ACT 2014-2015 CIRCULAR 17-2014

SOFTWARES AND FORMS FOR INCOME TAX:

| Income in 2015-16 | |

|---|---|

| Upto Rs. 2,50,000/- | No Tax ( Nil ) |

| Between Rs.2,50,001 to 5,00,000 | 10% Income in excess of Rs.2,50,000 |

| Between Rs.5,00,001 to 10,00,000 | Rs.30,000+ 20% of income in excess of Rs.5,00,000 lakhs |

| Above Rs.10,00,000 | Rs.1,30,000+30% of income in excess of Rs.1,00,000 |

| Income in 2015-16 | Tax |

|---|---|

| Upto Rs. 3,00,000/- | No Tax ( Nil ) |

| Between Rs.3,00,001 to 5,00,000 | 10% Income in excess of Rs.3,00,000 |

| Between Rs.5,00,001 to 10,00,000 | Rs.30,000+ 20% of income in excess of Rs.5,00,000 lakhs |

| Above Rs.10,00,000 | Rs.1,30,000+30% of income in excess of Rs.1,00,000 |

SOFTWARE FOR INCOME TAX 2014-2015

Income Tax software for 2012-2013

Read about Calculation of Income tax in Telugu - Click Here

HOUSE RENT RECEIPT FORM FOR INCOME TAX

ALL TYPES OF INCOME TAX FORMS...COMPLETE FORMS

READ THE INCOME TAX ACT AND INFORMATION

CIRCULAR NO : 05 /2011

USEFUL INFORMATION LINKS:

CALCULATE YOUR TAX BASING ON YOUR TAXABLE INCOME-click

File Income Tax returns ONLINE

Official Website of Income Tax Department

Income Tax Returns -Explanation in Telugu by CVS Mani

INCOME TAX FORMS:

INCOME TAX FORMS:

-

Certificate of prescribed authority for the purposes of section 80DDB

-

For All type of remaining Income tax returns forms- click here

| All APLICATION Forms Download Here(Click on Form No.) | |

| Return of income for block assessment | FORM NO.2B |

| Report under section 32(1)(iia) of the Income-tax Act, 1961 | FORM NO.3AA |

| Audit Report under section 32AB(5) | FORMNO.3AAA |

| Audit report under section 33AB(2) | FORM NO.3AC |

| Audit Report under section 33ABA(2) | FORM NO.3AD |

| Audit report under section 35D(4)/35E(6) of the Income- tax Act, 1961 | FORM NO.3AE |

| Report under section 36(1)(xi) of the Income-tax Act,1961 | FORM NO.3BA |

| Form of daily case register | FORM NO.3C |

| Audit report under section 44AB of the Income-tax Act, 1961 in a case where the accounts of the business or profession of a person have been audited under any other law | FORM NO.3CA |

| Audit report under section 44AB of the Income-tax Act, 1961, in the case of a person referred to in clause (b) of sub-rule (1) of rule 6G | FORM NO.3CB |

| Statement of particulars required to be furnished under section 44AB of the Income- | FORM NO.3CD |

| Audit Report under sub-section (2) of section 44DA of the Income-tax Act, 1961 | FORM NO.3CE |

| Report of an accountant to be furnished by an assessee under sub-section (3) of section 50B of the Income -tax Act, 1961 relating to computation of capital gains in case of slump sale | FORMNO.3CEA |

| Report from an accountant to be furnished under section 92E relating to international transaction(s) | FORMNO.3CEB |

| Application for a pre-filing meeting | FORMNO.3CEC |

| Application for an Advance Pricing Agreement | FORMNO.3CED |

| Application for withdrawal of APA request | FORM NO.3CEE |

| Annual Compliance Report on Advance Pricing Agreement | FORM NO.3CEF |

| Application form from scientific and industrial research organisations for approval under section 35 of the Income-tax Act | FORM NO.3CF |

| Order of approval of scientific research programme under section 35(2AA) of the Income-tax Act, 1961 | FORM NO.3CH |

| Receipt of payment for carrying out scientific research under section 35(2AA) of the Income-tax Act, 1961 | FORM NO.3CI |

| Report to be submitted by the prescribed authority to the Director General (Income-tax Exemptions) after approval of scientific research programme under section 35(2AA) of the Income-tax Act, 1961 | FORM NO.3CJ |

| Application form for entering into an agreement with the Department of Scientific and Industrial Research for co-operation in in-house Research and Development facility and for audit of the accounts maintained for that facility | FORM NO.3CK |

| Report to be submitted by the prescribed authority to the Director General (Income-tax Exemptions) under section 35(2AB) of the Income-tax Act, 1961 | FORM NO.3CL |

| Application for notification of affordable housing project as specified business under section 35AD | FORM NO.3CN |

| Notice of commencement of planting/replanting tea bushes | FORM NO.4 |

| Certficate of Planting /replanting Tea bushes | FORM NO.5 |

| Statement of particulers for purposes of section 33A relating to (a) planting of tea bushes on land not planted at any time with tea bushes or on land which had been previously abandoned; (b) replanting of tea bushes in replacement of tea bushes that have died or have become permanently useless on any land already planted | FORM NO.5A |

| Application for notification of a zero coupon bond under clause (48) of section 2 of the Application for notification of a zero coupon bond under clause (48) of section 2 of the Income-tax Act, 1961 | FORM NO.5B |

| Audit report under section 142(2A) of the Income-tax Act, 1961 | FORM NO.6B |

| Notice of demand under section 156 of the Income-tax Act, 1961 | FORM NO.7 |

| Declaration under section 158A(1) of the Income-tax Act, 1961 to be made by an assessee claiming that identical question of law is pending before the High Court or the Supreme Court | FORM NO.8 |

| Application for grant of approval or continuance thereof to a fund under section 10(23AAA) of the Income-tax Act, 1961 | FORM NO.9 |

| Notice of demand under section 156 of the Income-tax Act, 1961 | FORM NO.10 |

| Details of accounts under section 80G(5C)(v) of the Income-tax Act, 1961, for providing relief to the victims of earthquake in Gujarat | FORMNO.10AA |

| Audit report under section 12A(b) of the Income-tax Act, 1961, in the case of charitable or religious trusts or institutions | FORM NO.10B |

| Declaration to be filed by the assessee claiming deduction under section 80GG | FORM NO.10BA |

| Audit report under section 10(23C) of the Income-tax Act, 1961, in the case of any fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) of section 10(23C) | FORM NO.10BB |

| Audit report under section 80HH of the Income-tax Act, 1961 | FORM NO.10C |

| Audit report under section 80HHA of the Income-tax Act, 1961 | FORMNO.10CC |

| Audit report under section 80HHB of the Income-tax Act, 1961 | FORM NO.10CCA |

| Audit report under section 80HHBA of the Income-tax Act, 1961 | FORMNO.10CCAA |

| Certificate to be issued by Export House/Trading House to the supporting manufacturer for purposes of clause (b) of sub-section (4A) of section 80HHC | FORMNO.10CCAB |

| Certificate to be issued by an undertaking in the Special Economic Zone to the manufacturer undertaking referred to in sub-section (4C) of section 80HHC, for purposes of proviso to sub-section (4) of section 80HHC | FORMNO.10CCABA |

| Report under section 80HHC(4)/80HHC(4A) of the Income-tax Act, 1961 | FORM NO.10CCAC |

| Report under section 80HHD of the Income-tax Act, 1961 | FORM NO.10CCAD |

| Certificate from a person making payment to an assessee,engaged in the business of a hotel/tour operator/travel agent,out of Indian currency obtained by conversion of foreign exchange received from/on behalf of a foreign tourist/group of tourist | FORM NO.10CCAE |

| Report under section 80HHE(4)/80HHE(4A) of the Income-tax Act, 1961 | FORM NO.10CCAF |

| Certificate to be issued by exporting company to the supporting software developer for the purposes of clause (ii) of sub-section (4A) of section 80HHE | FORM NO.10CCAG |

| Certificate under clause (ia) of sub-section (3) of section 80HHB of the Income-tax Act, 1961 | FORM NO.10CCAH |

| Report under section 80HHF(4) of the Income-tax Act, 1961 | FORM NO.10CCAI |

| Audit report under sections 80-I(7)/80-IA(7)/80-IB | FORM NO.10CCB |

| Audit report under section 80-IB(7A) | FORM NO.10CCBA |

| Audit report under section 80-IB(14) | FORM NO.10CCBB |

| Audit report under section 80-IA(11B) | FORM NO.10CCBC |

| Certificate under sub-rule (3) of rule 18BBE of the Income-tax Rules, 1962 | FORM NO.10CCC |

| Certificate under sub-section (3) of section 80QQB for Authors of certain books in receipt of Royalty income, etc. | FORM NO.10CCD |

| Certificate under sub-section (2) of section 80RRB for Patentees in receipt of royalty income, etc. | FORM NO.10CCE |

| Report under section 80LA(3) of the Income-tax Act, 1961 | FORM NO.10CCF |

| Report under section 80JJAA of the Income-tax Act, 1961 | FORM NO.10DA |

| Form for evidence of payment of securities transaction tax on transations entered in a recognised stock exchange 1961 | FORM NO.10DB |

| Form for evidence of payment of securities transaction tax on transations tax on transactions of sale of unit of equity oriented fund to the mutual fund | FORM NO.10DC |

| Form for furnishing particulars of income u/s 192(2A) for the year ending 31st March,20..... for claiming relief u/s 89(1) by a Government servant/an employee in a company, co-operative society, local authority, university, institution,association/body | FORM NO.10E |

| Application for Certificate of residence for the purposes of an agreement under section 90 and 90A of the Income-tax Act, 1961 | FORM NO.10FA |

| Certificate of residence for the purposes of section 90 and 90A | FORM NO.10FB |

| Application for grant of approval or continuance thereof to institution or fund under section 80G(5)(vi) of the Income-tax Act, 1961 | FORM NO.10G |

| Certificate of foreign inward remittance | FORM NO.10H |

| Form of certificate under second proviso to section 80-O of the Income-tax Act, 1961 | FORM NO.10HA |

| Certificate of prescribed authority for the purposes of section 80DDB | FORM NO.10I |

| Certificate of the medical authority for certifying person with disability, severe disability, autism, cerebral palsy and multiple disability for purposes of section 80DD and section 80U | FORM NO.10IA |

| Application for registration of a firm for the purposes of the Income-tax Act,1961 | FORM NO.11 |

| Application for registration of a firm for the purposes of the Income-tax Act,1961 | FORM NO.11A |

| Declaratiion under section 184(7) of the Income-tax Act,1961 for continuation of registration | FORM NO.12 |

| Communication under clause (b) of Explanation below section 185(1) of the Income -tax Act, 1961, regarding partner who is benamidar | FORM NO.12A |

| Form for furnishing details of income u/s 192(2) for the year ending 31st March,.... | FORM NO.12B |

| Statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof | FORM NO.12BA |

| Application by a person for a certificate under section 197 and/or 206C(9) of the Income-tax Act, 1961, for no deduction/collection of tax or deduction of tax at a lower rate | FORM NO.13 |

| Application by a banking company for a certificate under section 195(3) of the Income-tax Act, 1961, for receipt of interest and other sums without deduction of tax | FORM NO.15C |

| Application by a person other than a banking company for a certificate under section 195(3) of the Income-tax Act, 1961, for receipt of sums other than interest and dividends without deduction of tax of tax | FORM NO.15D |

| Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax of tax | FORM NO.15G |

| Declaration under sub-section (1C) of section 197A of the Income-tax Act, 1961, to be made by an individual who is of the age of sixty-five years or more claiming certain receipts without deduction of tax | FORM NO.15H |

| Declaration for non-deduction of tax at source to be furnished to contractor under the second proviso to clause (i) of sub-section (3) of section 194C by sub-contractor not owning more than two heavy goods carriages/trucks during the Financial Year | FORM NO.15I |

| Particulars to be furnished by the Contractor under the third proviso to clause (i) of sub-section (3) of section 194C for the Financial Year____(Assessment Year___) | FORM NO.15J |

| Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source on Salary | FORM NO.16 |

| Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source | FORM NO.16A |

| Statement of tax deducted at source from contributions repaid to employees in the case of an approved superannuation fund | FORM NO.22 |

| Annual return of Salaries under section 206 of the Income-tax Act, 1961 for the year ending 31st March,_______ | FORM NO.24 |

| TDS/TCS Book Adjustment Statement | FORM NO.24G |

| Quarterly statement of deduction of tax under sub-section (3) of section 200 of the Income-tax Act, 1961 in respect of salary for the quarter ended June/September/December/March (tick which ever applicable)...(year) | FORM NO.24Q |

| Annual Return of deduction of tax under section 206 of Income-tax Act, 1961 in respect of all payments other than Salaries for the year ending 31st March,______ | FORM NO.26 |

| Form for furnishing accountant certificate under the first proviso to sub-section (1) of section 201 of the Income-tax Act, 1961 | FORM NO.26A |

| Annual Return of deduction of tax under section 206 of Income-tax Act, 1961 in respect of all payments other than Salaries for the year ending 31st March,______ | FORM NO.26AS |

| Quarterly statement of deduction of tax under sub-section (3) of section 200 of the Income-tax Act, 1961 in respect of all payments other than Salary for the quarter ended June/September/December/March (tick whichever applicable)...(year) | FORM NO.26Q |

| Particulars required to be maintained for furnishing quarterly return under section 206A | FORM NO.26QA |

| Quarterly return under section 206A for the quarter ended June/September/December/March (tick whichever applicable) of the Financial Year _____ | FORM NO.26QAA |

| Form for furnishing information with the statement of deduction/collection of tax at source (tick whichever is applicable) filed on computer media for the period (From.to..(dd/mm/yyyy) | FORM NO.27A |

| Form for furnishing information with the statement of collection of tax at source filed on computer media for the period ending...(dd/mm/yyyy) | FORM NO.27B |

| Form for furnishing accountant certificate under first proviso to sub-section (6A) of section 206C of the Income-tax Act, 1961 | FORM NO.27BA |

| Declaration under sub-section (1A) of section 206C of the Income-tax Act, 1961 to be made by a buyer for obtaining goods without collection of tax | FORM NO.27C |

| Certificate under section 206C of the Income-tax Act, 1961 for Tax collected at source | FORM NO.27D |

| Annual return of collection of tax under section 206C of I.T. Act, 1961 in respect of collections for the period ending.. | FORM NO.27E |

| Quarterly statement of Tax Collection at Source under section 206C of Income-tax Act, 1961 for the quarter ended June/September/December/March (tick whichever applicable)...(year) | FORM NO.27EQ |

| Quarterly statement of deduction of tax under sub-section (3) of section 200 of I.T. Act, 1961 in respect of payments other than Salary made to non-residents for the quarter ended June/September/December/March (tick which ever applicable)____(year) | FORM NO.27Q |

| Notice of demand under section 156 of the Income-tax Act, 1961 for payment | FORM NO.28 |

| Intimation to the Assessing Officer under section 210(5) regarding the notice of demand under section 156 of the Income-tax Act, 1961 for payment of advance tax under section 210(3)/210(4) of the Act | FORM NO.28A |

| Report under Section 115JB of the Income-tax Act, 1961 for computing the book profits of the company | FORM NO.29B |

| Report under section 115JC of the Income-tax Act, 1961 for computing adjusted total income and minimum alternate tax of the limited liability partnership | FORM NO.29C |

| Claim for refund of tax | FORM NO.30 |

| Form of undertaking to be furnished under sub-section (1) of section 230 of the Income-tax Act, 1961 | FORM NO.30A |

| No Objection Certificate for a person not domiciled in India under section 230(1) of the Income-tax Act, 1961 | FORM NO.30B |

| Form for furnishing the details under section 230(1A) of the Income-tax Act, 1961 | FORM NO.30C |

| Application for a certificate under the first proviso to sub-section (1A) of section 230 of the Income-tax Act, 1961 | FORM NO.31 |

| Clearance certificate under the first proviso to sub-section (1A) of section 230 of the Income-tax Act, 1961 | FORM NO.33 |

| Application for a certificate under section 230A(1) of the Income-tax Act, 1961 | FORM NO.34A |

| Form of application for settlement of cases under section 245C(1) of the Income-tax Act, 1961 | FORM NO.34B |

| Form of application for obtaining an advance ruling under section 245Q(1) of the Income-tax Act, 1961 | FORM NO.34C |

| Form of application by a resident applicant seeking advance ruling under section 245Q(1) of the Income-tax Act, 1961 in relation to a transaction undertaken or proposed to be undertaken by him with a non-resident | FORM NO.34D |

| Form of application by a person falling within such class or category of persons as notified by Central Government in exercise of powers conferred for obtaining and advance rulling u/s 245Q(1) of the Income-tax Act, 1961 | FORM NO.34E |

| Form of application for giving effect to the terms of any agreement under clause (h) of sub-section (2) of section 295 of the Income-tax Act, 1961 | FORM NO.34F |

| Appeal to the Commissioner of Income-tax (Appeals) | FORM NO.35 |

| Form of appeal to the Appellate Tribunal | FORM NO.36 |

| Reference application under section 256(1) of the Income- tax Act, 1961 | FORM NO.37 |

| Statement to be registered with the comptetent authority under section 269AB(2) of the Income-tax Act, 1961 | FORM NO.37EE |

| Form of appeal to the Appellate Tribunal against order of competent authority | FORM NO.37F |

| Statement to be furnished to the registering officer under section 269P(1) of the Income-tax Act, 1961 along with the instrument of transfer | FORM NO.37G |

| Fortnightly return under section 269P(2)(b) of the the Income-tax Act, 1961, in respect of the documents registered | FORM NO.37H |

| Statement of agreement for transfer of immovable property to be furnished to the appropriate authority under section 269UC of the Income-tax Act, 1961 | FORM NO.37I |

| Register of income-tax practitioners maintained by the Chief Commissioner or Commissioner of Income-tax.............. | FORM NO.38 |

| Form of application for registration as authorised income- tax practitioner | FORM NO.39 |

| Certificate of registration | FORM NO.40 |

| Form of nomination | FORM NO.40A |

| Form for modifying nomination | FORM NO.40B |

| Application for recognition | FORM NO.40C |

| Form for maintaining accounts of subscribers to a recognised provident fund | FORM NO.41 |

| Appeal against refusal to recognise or withdrawal of recognition from a provident fund | FORM NO.42 |

| Appeal against refusal to approve or withdrawal of approval from a superannuation fund | FORM NO.43 |

| Appeal against refusal to approve or withdrawal of approval from a gratuity fund | FORM NO.44 |

| Warrant of authorisation under section 132 of the Income-tax Act, 1961, and rule 112(1) of the Income-tax Rules, 1962 | FORM NO.45 |

| Warrant of authorisation under the proviso to sub-section (1) of section 132 of the Income-tax Act, 1961 | FORM NO.45A |

| Warrant of authorisation under sub-section (1A) of section 132 of the Income-tax Act, 1961 | FORM NO.45B |

| Warrant of authorisation under sub-section (1) of section 132A of the Income-tax Act, 1961 | FORM NO.45C |

| Information to be furnished to the income-tax authority under section 133B of the Income-tax Act, 1961 | FORM NO.45D |

| Application for information under clause (b) of sub-section (1) of section 138 of the Income-tax Act, 1961 | FORM NO.46 |

| Form for furnishing information under clause (b) of sub-section (1) of section 138 of the Income-tax Act, 1961 | FORM NO.47 |

| Form for intimating non-availability of information under clause (b) of sub-section (1) of section 138 of the Income-tax Act, 1961 | FORM NO.48 |

| Refusal to supply information under clause (b) of sub-section (1) of section 138 of the Income-tax Act, 1961 | FORM NO.49 |

| Application for allotment of Permanent Account Number under section 139A of the Income-tax Act, 1961 | FORM NO.49A |

| Application for allotment of Permanent Account Number under section 139A of the Income-tax Act, 1961 | FORM NO.49AA |

| Form of application for allotment of Tax Deduction Account Number under section 203A and Tax Collection Account Number under section 206CA of the Income-tax Act, 1961 | FORM NO.49B |

| Annual Statement under section 285 of the Income-tax Act, 1961 Act, 1961 | FORM NO.49C |

| Statement to be furnished to the Assessing Officer under section 285B of the Income-tax Act, 1961, in respect of production of a cinematograph film | FORM NO.52A |

| Application under section 281A(2) for obtaining a certified copy of notice under section 281A(1)/281A(1A)/281A(1B), of the Income-tax Act, 1961 | FORM NO.54 |

| Application for approval of an association or institution for purposes of exemption under section 10(23), or continuance thereof for the year.... | FORM NO.55 |

| Application for approval of a Venture Capital Fund or a Venture Capital Company | FORM NO.56A |

| Application for approval of a Venture Capital Fund or a Venture Capital Company | FORM NO.56AA |

| Condensed financial information income statement | FORM NO.56B |

| Condensed financial information Income statement | FORM NO.56BA |

| Statement of assets and liabilities | FORM NO.56C |

| Statement of assets and liabilities | FORM NO.56CA |

| Application for approval under section 10(23G) of an enterprise wholly engaged in the eligible business | FORM NO.56E |

| Report under section 10A of the Income-tax Act, 1961 | FORM NO.56F |

| Particulars to be furnished under clause (b) of sub-section (1B) of section 10A of the Income-tax Act, 1961 | FORM NO.56FF |

| Report under Section 10B of the Income-tax Act, 1961 | FORM NO.56G |

| Report under section 10BA of the Income-tax Act, 1961 | FORM NO.56H |

| Certificate under section 222 or 223 of the Income-tax Act, 1961 | FORM NO.57 |

| Application for approval of issue of public companies under section 88(2)(xvi) of the Income-tax Act | FORM NO.59 |

| Application for approval of mutual funds investing in the eligible issue of public companies under section 88(2)(xvii) of the Income-tax Act | FORM NO.59A |

| Form of declaration to be filed by a person who does not have either a permanent account number or General Index Register Number and who makes payment in cash in respect of transaction specified in clauses (a) to (h) of rule 114B | FORM NO.60 |

| Form of declaration to be filed by a person who has agricultural income and is not in receipt of any other income chargeable to income-tax in respect of transactions specified in clauses (a) to (h) of rule 114B | FORM NO.61 |

| Annual Information Return under section 285BA of the Income-tax Act, 1961 | FORM NO.61A |

| Certificate from the principal officer of the amalgamated company and duly verfied by an accountant regarding achievement of the prescribed level of production and continuance of such level of prduction in subsequent years | FORM NO.62 |

| Statement to be furnished to the Assessing Officer designated under rule 12B of the Income-tax Rules, 1962, in respect of income distributed by the Unit Trust of India | FORM NO.63 |

| Statement to be furnished to the Assessing Officer designated under rule 12B of the Income-tax Rules, 1962, in respect of income distributed by a Mutual Fund | FORM NO.63A |

| Statement of income distributed by Venture Capital Company or a Venture Capital Fund to be furnished under section 115U of the Income-tax Act, 1961 | FORM NO.64 |

| Application for exercising/renewing option for the tonnage tax scheme under sub-section (1) of section 115VP or sub-section (1) of section 115VR of the Income-tax Act, 1961 | FORM NO.65(New) |

| Audit Report under clause (ii) of section 115VW of the Income-tax Act, 1961 | FORM NO.66 |

Online Application for NEW PAN (Form 49A)(Select the Your Category at the bottom)

DO's and Dont's for new PAN APPLICATION

Important Guidelines and Instructions at a Glance

Form for Changes or Corrections in PAN

Track Your PAN Application Status

.jpg?ph=8f1064689b)